The Government has demonstrated its commitment to decarbonising heat and buildings through policy and billions of pounds of funding. It has also recognised that highly efficient, low carbon heat pumps have a vital role to play in creating a cleaner, greener future for the UK.

A number of initiatives currently exist to incentivise the adoption of ground source heat pumps. Have a look at the heat pump funding and grants that could support your project.

Jump to:

-

-

-

-

-

-

- Scottish Green Public Sector Estate Decarbonisation Scheme

-

-

Boiler Upgrade Scheme (BUS)

Opened in April 2022 in England and Wales, the Government’s Boiler Upgrade Scheme (BUS), offers households capital grants to replace fossil fuel heating systems with more efficient low-carbon heat pumps.

Homes retrofitting ground source heat pumps will receive £7,500 when the system is commissioned. As this is a domestic scheme, there is a 45kW heat pump size limit per property. Social landlords and new buildings (except custom-built) are not eligible.

The Government has announced a further £1.5 billion of funding for the BUS, which covers the spending review period from 2025 to 2028. Calculations by the Heat Pump Association suggest this will fund 206,000 heat pump installations.

Discover the Boiler Upgrade Scheme

Domestic Scottish Funding

Have property in Scotland? Grant funding is available for installing domestic heat pumps of up to £7,500, (or £9,000 for households that qualify for a rural uplift). Additional funding can be requested as an optional interest-free loan.

Home Energy Scotland Grant and Loan – you can now apply for grant funding without taking out a loan. A rural uplift is also available to provide extra support to rural and island homes which can face increased costs to install home improvements.

Warmer Homes Scotland – you could get funding from the Scottish Government to make energy efficiency improvements, like new heating or insulation. The improvements offered will depend on a survey of the home. Assessors will come to your home to survey it and will recommend improvements suitable for the home, which could include a range of insulation and heating.

The Energy Company Obligation (ECO)

The ECO is a Government grant for retrofitting ground source heat pumps into social housing properties. It places legal obligations on larger energy suppliers to fund efficiency measures for domestic energy users.

DISCOVER ECO

ECO4

The government’s response to ECO4 consultation sets out the policy of the scheme from April 2022 until March 2026. Please click on the link below to find out more about ECO4.

Green Heat Network Fund (GHNF)

This scheme intends to help new and existing heat networks to move to low and zero-carbon technologies. The fund is anticipated to run from April 2022 to November 2024.

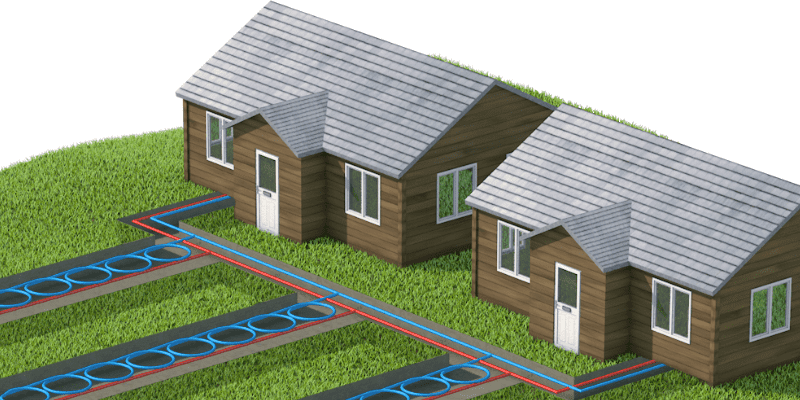

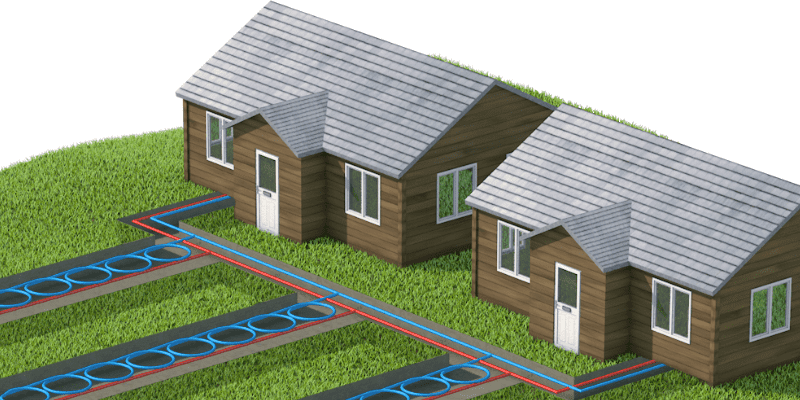

Aimed at developers and investors in low-carbon heat networks, such as Shared Ground Loop Arrays, the objectives are to achieve carbon savings, increase the amount of low-carbon heat utilisation in heat networks and help prepare the market for low-carbon regulation.

See more information or contact us for more details.

Discover the GHNF

Social Housing Decarbonisation Fund (SHDF)

The government committed to the Social Housing Decarbonisation Fund (SHDF) in 2019, with a proposed £3.8bn available over a 10-year period. The SHDF will upgrade a significant amount of social housing stock to an Energy Performance Certificate rating of C through insulation measures or retrofitting inefficient heating, improving energy performance and lowering bills.

In December 2023, it was announced that the SHDF has been allocated £1.25bn to support up to 140,000 social homes. Social landlords can plan and invest in further retrofit works to help lift residents out of fuel poverty, ensuring they live in warm homes that are affordable to heat.

Discover the SHDF

The fund will help:

- deliver warm, energy-efficient homes

- reduce carbon emissions and fuel bills

- tackle fuel poverty

- support green jobs.

Wave 3 of SHDF is due to open for applications in Summer 2024 (dates subject to change). It is crucial to get bid-ready so you can apply when the window opens. Contact Kensa for help.

Public Sector Decarbonisation Scheme (PSDS)

Eligible projects

The PSDS is a £1billion fund dedicated to heat decarbonisation and capital energy efficiency projects in non-domestic public sector buildings across England. Covering up to 88% of ground source heat pump installation costs, the scheme’s objective is to achieve significant carbon savings within the sector.

Eligible public sector bodies include:

- Emergency services

- NHS Trusts & Foundation Trusts

- Further & higher education institutions

- Local authorities

- Maintained schools within the state education system

- Nursery schools maintained by a local authority

- Central government departments & non-departmental government bodies

- MOD estate

DISCOVER THE PSDS

Guidance on Phase 4 will be released in summer 2024.

The annual funding allocation for Phase 4 of the Public Sector Decarbonisation Scheme:

£670 million available in 2025/2026 – up to £335 million of this funding is allocated to the second year of PSDS Phase 3c.

£300 million available in 2026/2027

£200 million available in 2027/2028

Be ‘shovel ready’ for 2025/2026 funding

With each funding round oversubscribed and short timescales to submit bids, projects need to be ‘shovel-ready’ to have a chance of success.

Kensa has already assisted a number of local authorities and institutions to secure PSDS funding.

Contact us to discuss potential schemes, and we can support any application bids.

CONTACT US

Scottish Green Public Sector Estate Decarbonisation Scheme

A £20 million Public Sector Heat Decarbonisation Fund is accelerating the decarbonisation of public sector properties, such as leisure centres, schools, and university campuses.

The funding, to support the ambition to reach net zero by 2045, is the first time direct grant awards have been made to public sector bodies in Scotland instead of loans.

The application portal closed on Tuesday 5 December 2023.

Ground Array Funding

Ground array funding covers the cost of the groundwork for ground source heat pumps. Through this scheme, arranged by Kensa Utilities, an investor funds the network – known as Shared Ground Loop Arrays – to cover the most expensive aspect of the project. In return, the investor can charge connection fees if they wish.

Meanwhile, the developer or property owner benefits from a cheaper project, with all the efficient advantages of ground source over air source.

DISCOVER GROUND ARRAY FUNDING

ZERO

ZERO enables social housing providers and local authorities with a housing stock of 3,000+ homes to access whole stock retrofit with no upfront costs.

Kensa will manage the delivery of this, including the installation of heat pumps, PV and batteries for a diverse range of building types.

DISCOVER ZERO